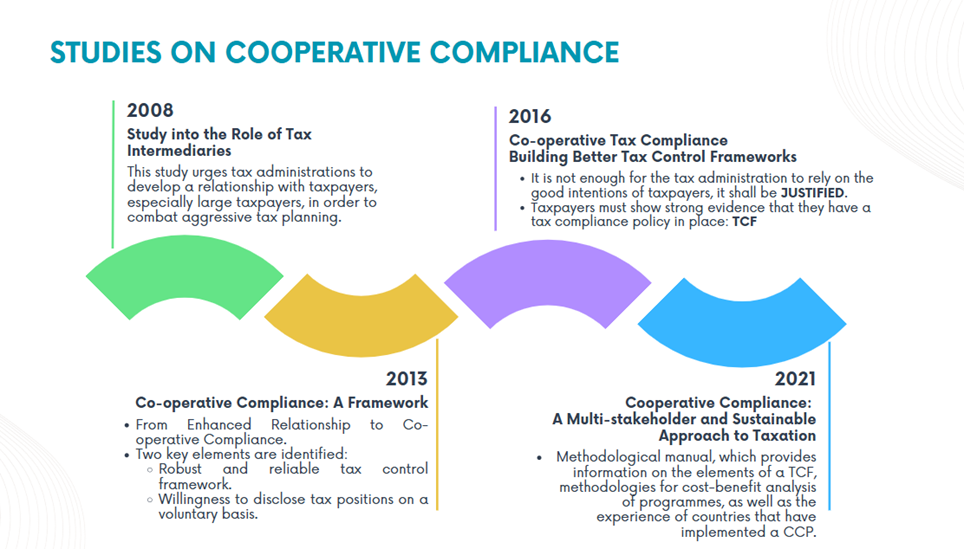

Cooperative Compliance (as it is known internationally) has its origin in the report “Study on the role of tax intermediaries”, published in 2008 by the Tax Administration Forum - FAT, of the Organization for Economic Cooperation and Development - OECD. This study called for the promotion of an environment conducive to mutual trust and cooperation on the part of the tax administrations, in order to establish a “cooperative relationship” with taxpayers.

Subsequently, the OECD pointed out that for this type of relationship to work effectively, trust between the TA and Taxpayers should be based on solid evidence that reflects the correct fulfillment of tax obligations. Therefore, in 2016, it published a report on how to create better MCFs, pointing out their characteristics, evaluation methodology and verification.

As Owens (2023) mentions, cooperative compliance is a concept based on trust and cooperation, which is why he defines it as a program open to large companies that voluntarily wish to join, in which tax authorities offer services of the highest quality and timeliness, providing taxpayers with the legal certainty demanded by international investors and reducing litigation.

Currently, cooperative compliance is an approach that is being used by six out of ten tax administrations worldwide (Owens, 2023). In the case of Latin American and Caribbean countries, Brazil has a formal cooperative compliance program, while some other countries in the region are building their own programs. This reflects the global trend of promoting cooperative compliance as a recognized method to improve tax compliance, as it is an alternative that leads to better communication between taxpayers and tax administrations, building a horizontal relationship with them, based on transparency, cooperation, legal certainty and justified trust.

International Taxation

International Taxation