1. Has a new tax been created to be levied on digital platforms?

No, a new tax has not been created to tax digital platforms. Digital services and import of intangible assets were already taxed with VAT. A more efficient VAT collection system is being implemented in those cases in which the suppliers of these services and intangible assets are not physically in Peru (non-residents).

2. What digital services are included in this new tax collection mechanism?

The following digital services are taxed with the VAT:

a. On-line access and/or transmission of images, series, films, documentaries, short films, videos, music and any other digital content through streaming technology or any other type of technology.

b. Data storage.

c. Access to social network and/or provision of content or their additional functions.

d. Service provided by on-line magazines or newspapers

e. Remote conference services

f. Intermediation services on the supply and demand of goods and services.

g. Other digital services: not included within the list provided that they meet the following:

i) they are available to the user through Internet (or any other network) through on-line access.

ii) It is characterized by being essentially automatic and

iii) not being feasible if there is lack of information technology

In any case, it is a requirement that the digital service user or acquirer of the intangible assets must:

- Be an individual not conducting any business activity

- Has their usual residence in Peru

Only operations implying a payment by the user or acquirer will be taxed with the VAT, that means that if they are free operations, they will not be taxed with the VAT.

3. In what cases it is considered that the user of digital services or acquirer of intangible assets has a usual residence in Peru?

In any of the following cases:

i. The internet protocol (IP) address or other means of geographical location corresponds to Peru, as well as the country code of the subscriber identity module (SIM)

ii. The payment is made using credit or debit cards or other product provided by the Peruvian financial system entities.

iii. The domicile recorded as user information or address for the issuance of payment vouchers shall be located in Peru.

4. Who will be in charge of paying the VAT before SUNAT with this new tax collection mechanism?

The non-resident rendering the digital service or from whom the digital service is acquired. In these cases, they act as VAT withholding or collection agents for this type of operations conducted with individuals without business activity and with usual residence in Peru who are the VAT taxpayers.

5. In what cases we deal with an intermediation service in the supply and demand?

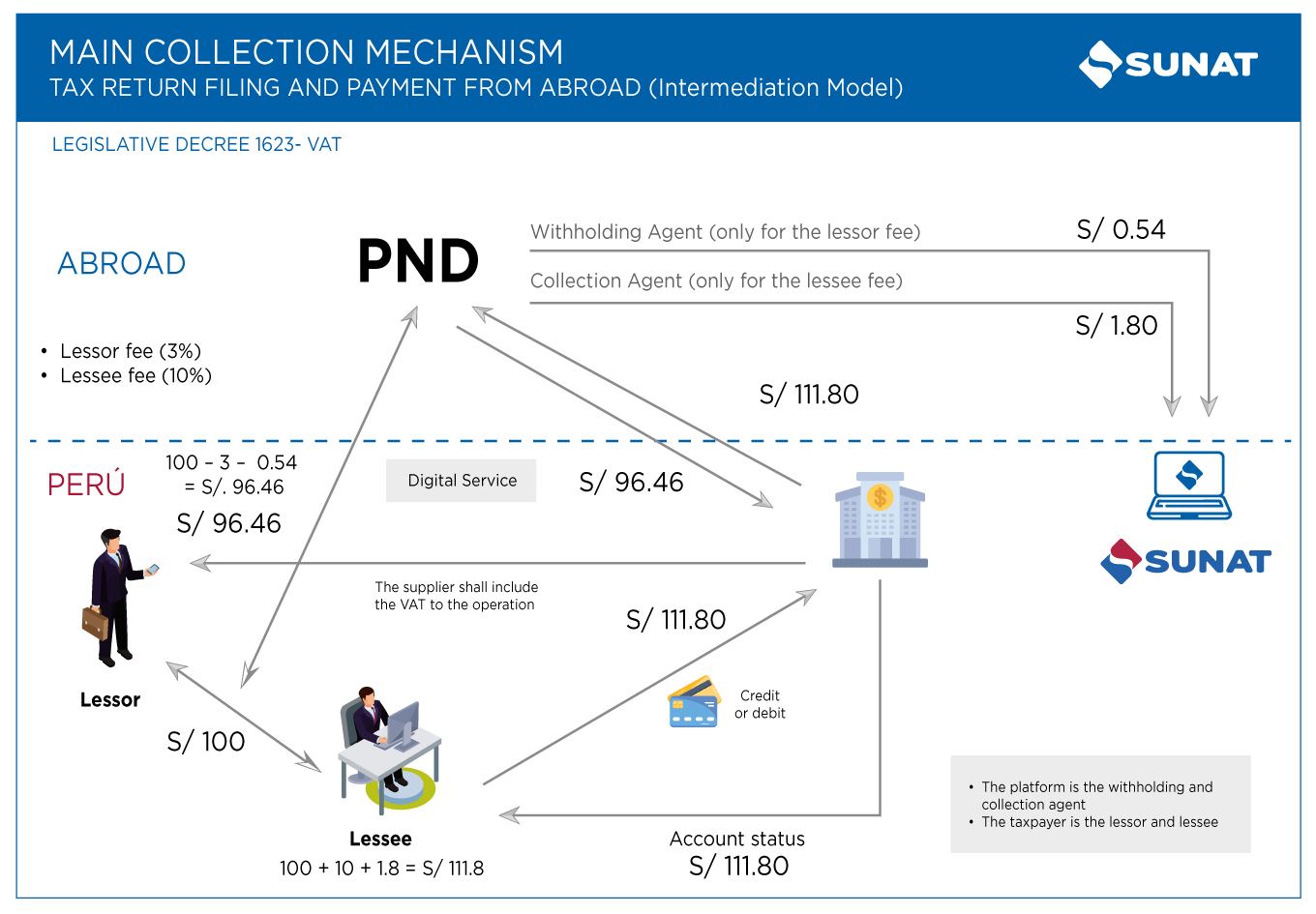

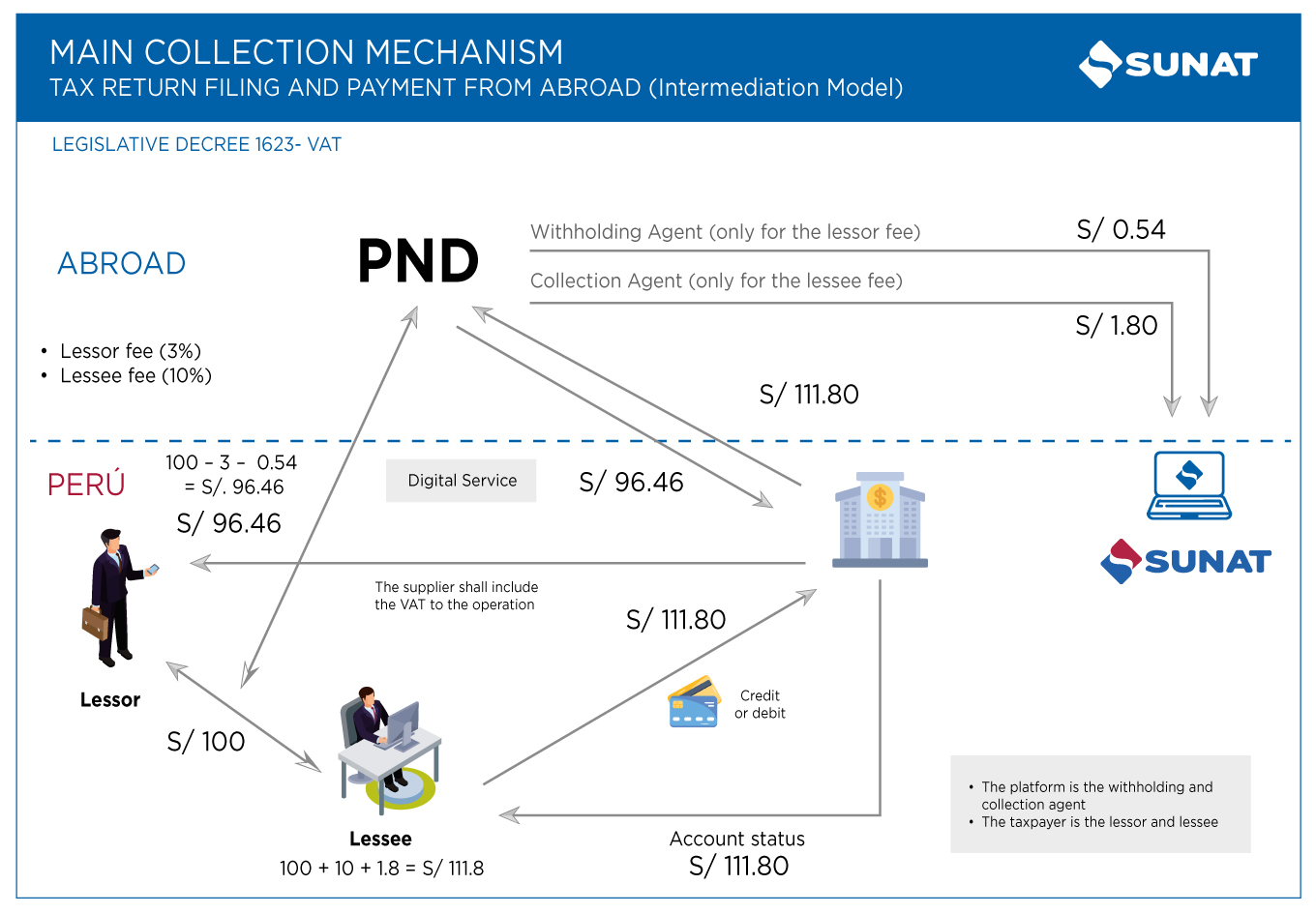

We deal with an intermediation service in the supply and demand when the business model of the digital service supplier facilitates the interaction (intermediation) between suppliers and clients of goods or services (underlying transaction). As a result, the supplier of this digital intermediation service will charge a fee as detailed in the following chart:

In this case, the VAT would be applied on the fees collected by such intermediation service, as it can be seen in the following example:

RUC registration requirement

6. Are non-resident suppliers of digital services and intangible assets required to get registered?

Yes, non-resident suppliers of digital services and intangible assets are required to get registered as set forth in subclause 1 of article 49-A of the VAT Law included by means of Legislative Decree 1623 by providing that “the above-mentioned non-residents shall register in the Single Registry of Taxpayers”.

7. What will happen to non-residents that do not register in SUNAT?

If non-residents required to register in SUNAT do not meet this requirement, they will be subject to infringements and sanctions established in the Peruvian legislation, regardless of the corresponding collection and/or withholding.

8. In the RUC registration process what services would be included in the options “other rendered digital services” or “Other intermediation digital service”?

These options are used when the digital service rendered by non-resident suppliers is not expressly described in the registration platform list as long as they comply with the idea that such services made available to the user through Internet be mainly automatic and they are not viable due to the lack of information technology.

9. What documents (pdf format) should I enclose in my online RUC registration procedure?

- Copy of the articles or incorporation. If the document is in a language other than Spanish, please enclose a non-sworn translation. (Pdf Format).

- Copy of the ID document of the Legal Representative and Contact Person (pdf format) in the event they are Individuals.

- Copy of the document of appointment as Legal Representative (Pdf Format).

10. What is the website requested for RUC registration?

It is the website or URL of the non-resident through which they conduct their business activities. It is to be noted that it is not the website or personal user account of the legal representative or contact person.

11. If a non-resident is not registered in the Single Taxpayer Registry (RUC), will they also be required to withhold and/or collect the VAT as of December 1, 2024?

It is mandatory that non-residents registered in the RUC, withhold and/or collect the VAT and also file and pay the VAT before SUNAT. They are independent obligations. The status of VAT withholding or collection agents of non-residents is not subject to the willingness to register in the RUC. Therefore, even though they are not registered in the RUC, non-residents shall withhold and/or collect the VAT.

VAT withholding and/or collection requirement

12. From what moment VAT collections and withholdings shall be made?

As of December 1, 2024 it is necessary to make the VAT collections and withholdings of digital services and intangible assets, which shall be filed and paid before SUNAT the following month.

Filing and Payment requirement of the withheld and/or collected VAT

13. How will non-resident suppliers of digital services and intangible assets file and pay the VAT?

First, these non-resident suppliers shall register in the RUC before SUNAT through a simplified form: https://www.sunat.gob.pe/ol-ti-itpreinscripnodomic/registro

Instructions Guide for RUC Registration:

https://cdn.www.gob.pe/uploads/document/file/6938233/5941132-ruc-registration-of-non-residents.pdf?v=1726259303

Subsequently, they will file and pay the VAT withheld and collected to individuals residing in Peru under the form and conditions established by SUNAT.

14. How do we file and pay the withheld or collected VAT before SUNAT?

Non-residents shall file and pay the withheld or collected VAT every month within the first ten (10) working days of the following month.

The time zone considered to set the date when the VAT filing and payment shall be made will be the Official Peruvian Time, GMT-5.

15.Is it possible to file and pay the VAT in a currency other than the Peruvian Nuevo Sol?

The filing and payment could be made only in local currency or US dollars. The option is exercised in the filing made in January and is maintained throughout the year.

Exceptionally, this option could be exercised for the filing and payment corresponding to December 2024.

16. When is it possible to make the first VAT return filing??

The deadline to file the first VAT return and make the corresponding payment of the VAT withheld or collected as of December 1, 2024 will expire in January 2025

17. Are non-residents required to withhold or collect the VAT or any other tax for the underlying service regarding intermediation services?

Currently, the regulation does not consider this possibility. Non-residents, in the case of intermediation services, will only withhold the VAT related to the fee charged for the use of the virtual platform on intermediation services.

18. What type of exchange rate is used in cases in which the non-resident conducts foreign currency transactions and opts for making the filing in nuevos soles?

For the filing and payment in local currency, the conversion is made using the weighted average selling exchange rate published by the Superintendency of Banking, Insurance and Private Pension Fund Administrators (SBS) in its website or the Official Gazette El Peruano corresponding to the date when the payment is made, whichever occurs first.

19. If a nonresident supplier provides a digital service or transfers an intangible asset from a nonresident Marketplace to an Individual residing in Peru without business activity, Who is required to collect/withhold the VAT and therefore, register as collection/withholding agent, file a tax return and pay the VAT?

- In this case, the obligation falls on the supplier of the digital service or transferor of the intangible asset who will be required to register in the Single Taxpayers’ Registry (RUC) as collection agent, as well as filing a tax return and paying the VAT of such transactions within the established timeframes.

- Notwithstanding the foregoing, to the extent the “Marketplace” provides an intermediation service between a supplier (resident or nonresident) and a Peruvian resident and charges the latter a fee (or rate), it will also be required to register in the RUC and collect the VAT in respect of the fee (or rate) received from such intermediation service. Likewise, the Marketplace will also be required to collect the VAT in respect of digital services or intangible assets when it directly provides such services or transfers such intangible assets.

20. When does this collection mechanism, carried out by payment facilitators, enter into force in the event that VAT collection and/or withholding agents do not comply with their obligations?

The collection mechanism carried out by payment facilitators is not still in force; thus, its regulation is still pending.

In that sense, as of December 1, 2024, the nonresident suppliers of digital services and sale of intangible assets are the solely responsible as VAT collection and/or withholding agents for the following:

1. To register in the Single Taxpayer’s Registry (RUC)

2. To collect and/or withhold the VAT

3. To file a VAT return and pay the VAT before SUNAT

Non-compliance with these obligations would represent punishable offences as set forth in the Tax Code.

21. I am a nonresident supplier of digital services. A client (Individual) registered in the platform through Single Taxpayers’ Registry number (RUC) beginning with digit “1”; however, based on the information registered in the platform, it is not possible to differentiate or identify whether they are individuals or companies, should I collect and/or withdraw VAT to such client?

If a person registers or is identified in a digital platform as Individual and indicates a RUC number beginning with digit “1”, it does not mean or imply that it is a person conducting a business activity, because they can also be Individuals required to register through the RUC for other type of income (non-business income) as set forth in Superintendency Resolution 210-2004/SUNAT and amendments.

In that sense, as established in Legislative Decree 1623, when the platform does not have options to differentiate between individuals and companies (not been sufficient, for that purpose, including a RUC number beginning with digit “1” as identification,), it shall be understood that the Individual does not conduct any business activity; thus, the suppliers of digital services or sale of intangible assets shall withhold and/or collect the VAT.

Nevertheless, if the Individuals registered in the platform conduct a business activity, they would be able to use the withheld or collected VAT as tax credit as long as they meet the requirements stipulated in the law.

22. How are non-residents going to ask questions and/or request clarification?

Please, feel free to make your questions and request clarification at inscripcionruc_nd@sunat.gob.pe

International Taxation

International Taxation