OBLIGATED PARTIES:

Non-domiciled taxpayers who acquire the status of withholding or collection agents of the General Sales Tax when they provide digital services or sell intangible goods through the Internet, and the user or importer is a natural person who does not carry out business activities and whose habitual residence is located in the country, are required to register in the Single Taxpayers Registry (RUC).

PLACES AND MEANS TO REGISTER IN THE RUC AND, IF APPLICABLE, TO BECOME A USER OF SUNAT ONLINE OPERATIONS.

Only through SUNAT Virtual (www.sunat.gob.pe).

INFORMATION TO BE PROVIDED BY THE NON-DOMICILED SUBJECT:

Non-domiciled taxpayers, at the time of requesting their registration in the RUC, must provide the following information:

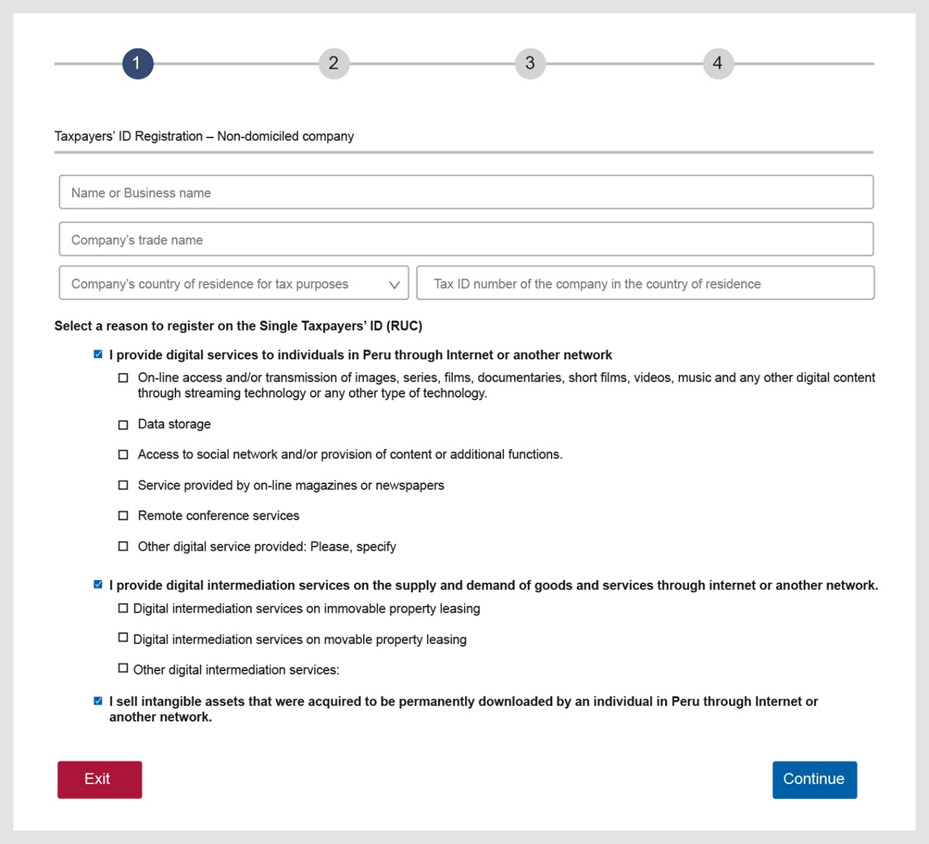

- Data relating to identification: Name or company name.

- Country of residence.

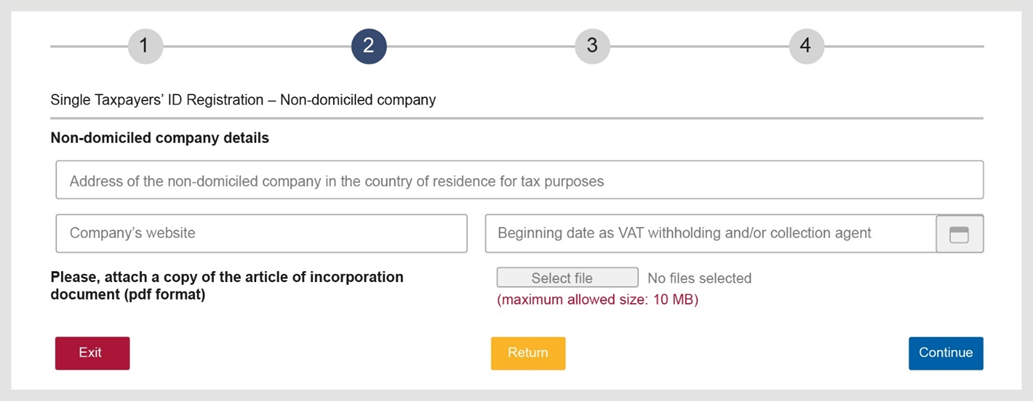

- Address in the country of residence.

- Tax identification number in the country of residence.

- Trade name, if available.

- Business activity(ies), data from which SUNAT registers the General Sales Tax for perceptions or withholdings, as appropriate.

- Beginning date, date from which the non-domiciled subject acquires the status of withholding or collection agent of the General Sales Tax when using digital services or importing intangible goods through the Internet, mentioned in article 49-A of the General Sales Tax and Selective Consumption Tax Law.

- Web address or URL (Uniform Resource Locator).

INFORMATION TO BE PROVIDED BY LEGAL REPRESENTATIVES: (*)

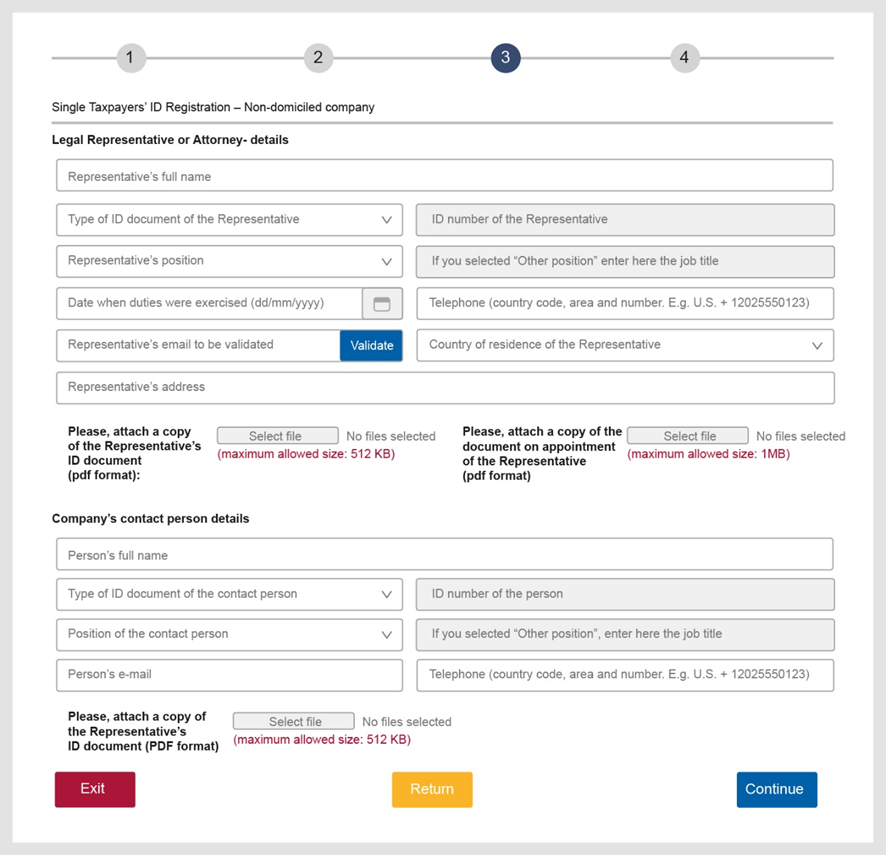

- Name(s) and surname(s), denomination, or company name, as applicable.

- Type and number of identity document.

- Position.

- Date since he/she has held office.

- Address in the country of residence.

- E-mail address.

- Mobile phone, whether or not you are the owner of the telephone service.

INFORMATION TO BE PROVIDED BY THE CONTACT PERSON: (*)

- First name(s) and last name(s).

- Type and number of identity document.

- Position in the company, if any.

- E-mail address.

- Mobile phone, whether or not you are the owner of the telephone service.

(*) The legal representatives of non-domiciled entities, if they are natural persons, their attorneys-in-fact and the contact person declared by them are identified with the document that proves their identity, according to the regulations of the country in which they are issued.

IMPORTANT NOTE:

For further information, you can contact us by e-mail: inscripcionruc_nd@sunat.gob.pe

PROCEDURE:

- Non-domiciled Subject Information Record:

1.1. Enter the SUNAT WEB Portal: www.sunat.gob.pe

1.2. Enter the requested information of the non-domiciled subject

1.3 Attach a copy of the company's incorporation document (PDF format).

- Legal Representative Information Record:

Enter the requested information of the legal representative.

Attach copy of the legal representative's identity document (PDF format)

Attach a copy of the document of designation as legal representative (PDF format).

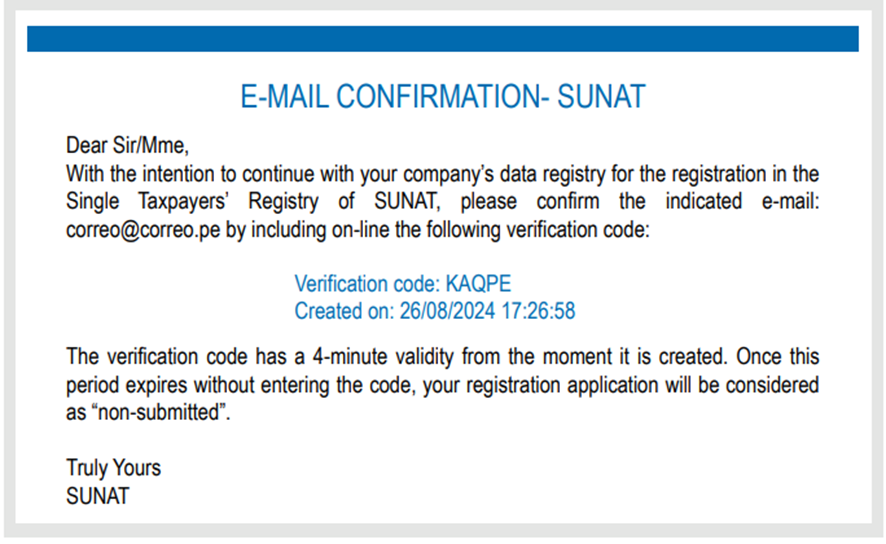

2.4. Validate the legal representative's e-mail.

2.5. Enter the "Verification Code" that will be sent to the legal representative's confirmed e-mail address.

3. Record of Contact Person Information:

3.1. Enter the requested information of the Contact Person

3.2. Attach a copy of the Contact Person's identity document (PDF Format)

4. Sending the Application for Registration in the Single Taxpayers Registry:

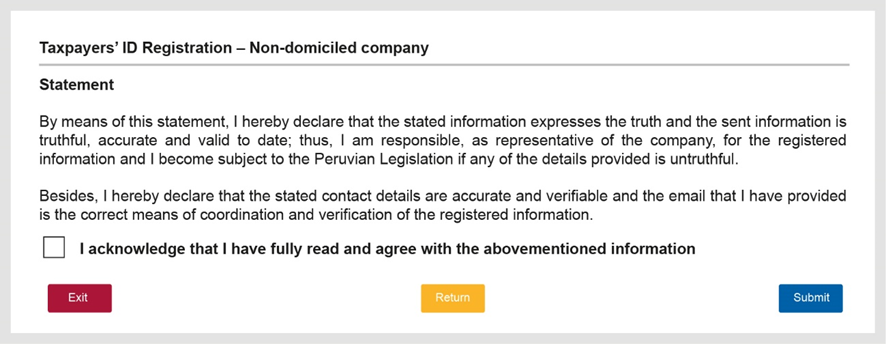

4.1. Verify the information contained in the Summary of Recorded Information.

4.2. Check the Accept button.

4.3. Submit the application.

4.4. A message will be sent to the e-mail indicating that the application has been successfully registered and an application number will be assigned.

Evaluation of the application for registration in the RUC:

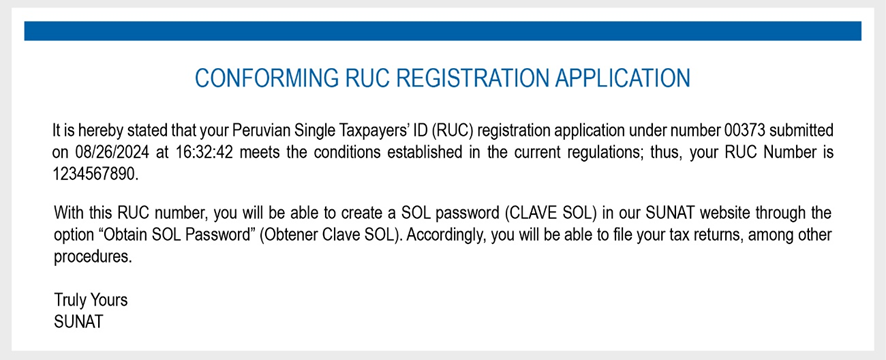

5.1. Once the application for registration in the RUC of the non-domiciled subject has been evaluated by SUNAT personnel, an e-mail will arrive to the legal representative with the result of the evaluation.

5.2. If the result of the application is CONFORMABLE, the RUC number will be issued.

5.3. If the result of the application is NOT CONFORMED, the non-domiciled subject may reapply for registration in the RUC, after correcting the observations that led to its rejection.

- Generation of the SOL Key:

6.1. Enter the SUNAT WEB Portal: www.sunat.gob.pe

6.2. Locate the SOL Key Generation option.

6.3 Enter the RUC number of the non-domiciled subject.

6.4 Complete the information requested from the legal representative.

6.5 Dial the start button.

6.6 Enter the "Verification Code" that will be sent to the legal representative's e-mail address.

6.7 Create and enter a secure password and repeat it again.

6.8 A message will appear indicating that your operation has been successful and that you can enter the "SUNAT Operaciones en Línea-SOL" environment

7. Anexo N.° 1-E incorporado a la Resolución de Superintendencia N° 210-2004. Ingresa Aqui

PROCEDURE GUIDANCE:Click here to find out the Procedure Guidance for your registration.

PROCEDURE GUIDANCE:Click here to find out the Procedure Guidance for your registration.

International Taxation

International Taxation