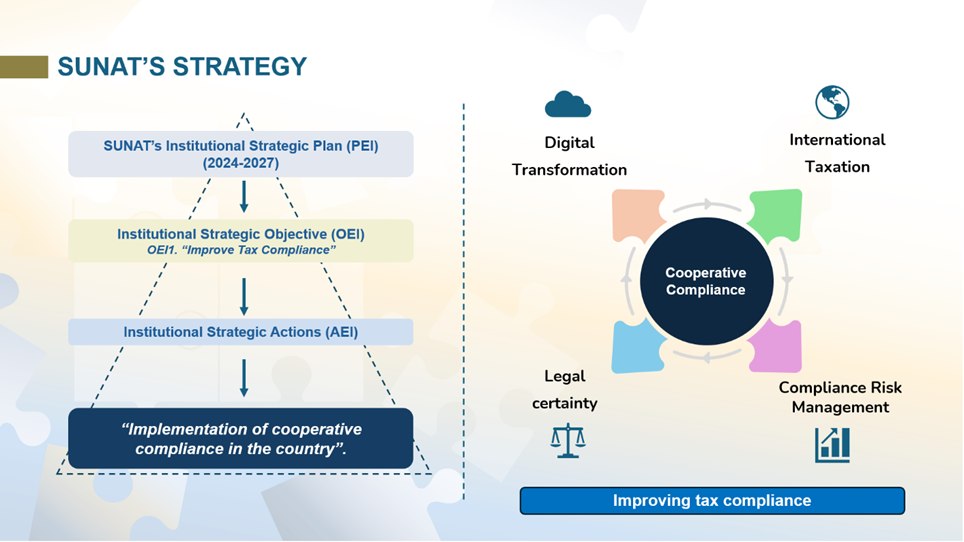

The Strategic Institutional Plan of SUNAT for the period 2024-2027, approved on March 28, 2024, by means of Superintendence Resolution No. 068-2024/SUNAT, establishes that, in order to serve the country through the fair, integral, effective, and efficient administration of the tax and customs system, necessary for the economic and social development of Peruvians, SUNAT will address five (05) strategic objectives.

In this regard, through Strategic Objective 01: “Improve the tax and customs compliance of taxpayers”, SUNAT will develop strategies, actions and measures that will allow a sustained increase in the levels of compliance of taxpayers with respect to the obligations it is responsible for administering, through the implementation of a compliance risk management model and following the highest international standards. In this sense, it will focus on promoting voluntary compliance, implementing solutions that limit the possibilities of non-compliance and executing measures that effectively address evasion, avoidance and tax/customs crimes, taking advantage of the availability of information and the most advanced technological solutions, through the appropriate application of its powers.

Likewise, within the framework of the aforementioned strategic objective, the institutional strategic action “Implementation of cooperative compliance in the country” has been considered, whose strategy, following international best practices, will be based on risk management, since it allows responding to the most relevant tax non-compliances with differentiated treatments according to the taxpayer's behavior, as well as allowing the implementation with priority simplicity mechanisms in the compliance with tax obligations, mainly for those willing to do the right thing.

International Taxation

International Taxation