It is an information affidavit established in subclause 15.3 of Section 87 of the Single Revised Text (TUO, for its Spanish acronym) of the Tax Code, containing the information of the beneficial owner.

Legal Basis: Subparagraph b) of paragraph 3.1 of Section 3 of Legislative Decree 1372.

Term for filing the affidavit

The filing of the affidavit by liable taxpayers will be gradually made.

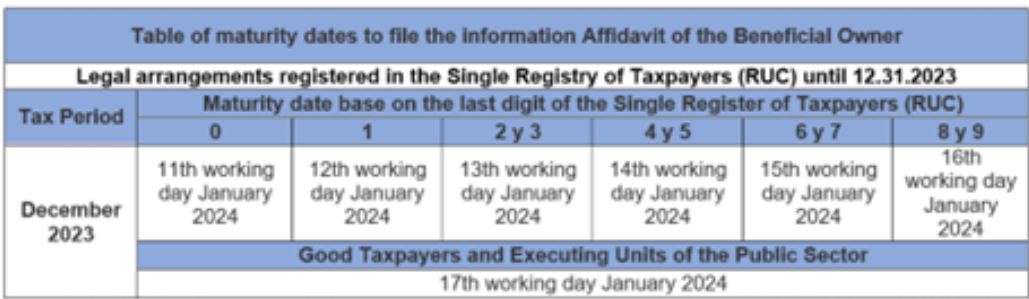

In years 2022 to 2024, as set forth in subparagraphs a) (legal persons) and b) (legal arrangements) of Section 2 of 000041-2022/SUNAT

, liable taxpayers shall file the beneficial owner’s information to SUNAT, as detailed below:

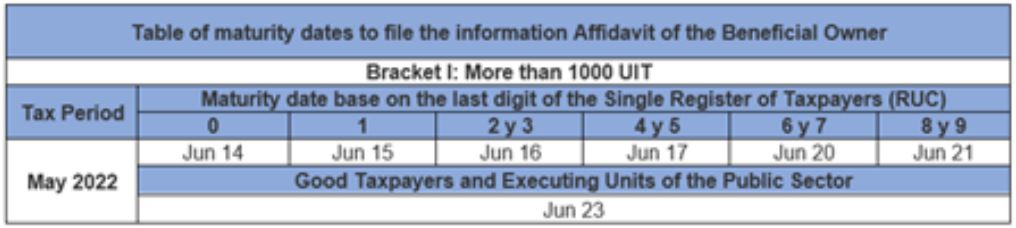

- The informative affidavit of the Beneficial Owner corresponding to Bracket I (legal persons declaring net income exceeding 1000 tax units (UIT) with regard to period 2021), in the month of June and taking into consideration tax period May 2022 (*) as the deadline.

(*) Established in Appendix I of Superintendence Resolution N. º 000201-2021/SUNAT

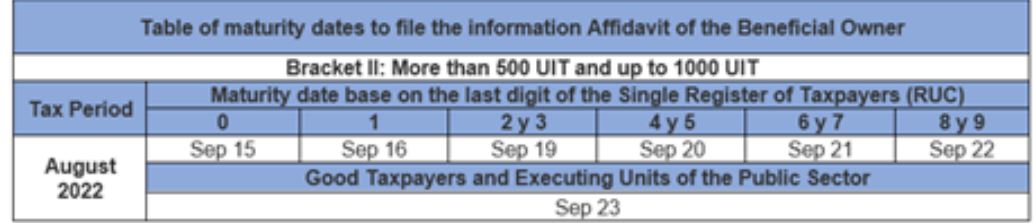

The informative affidavit of the Beneficial Owner corresponding to Bracket II (legal persons declaring net income exceeding 500 tax units (UIT) to 1000 tax units (UIT) with regard to period 2021), in the month of September, and taking into consideration tax period August 2022 (*) as the deadline.

(*) Established in Appendix I of Superintendence Resolution N. º 000117-2022/SUNAT

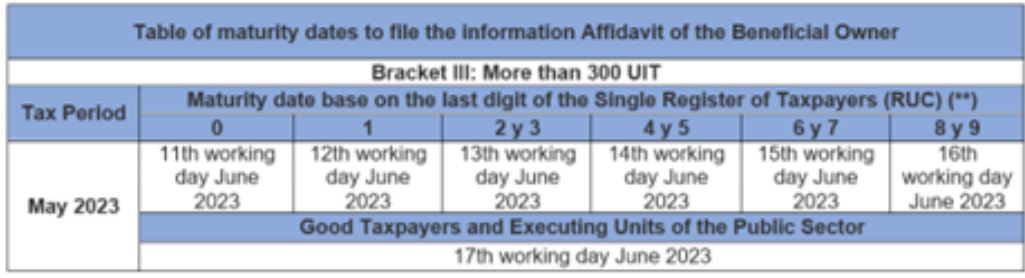

- The informative affidavit of the Beneficial Owner corresponding to Bracket III (legal persons declaring net income exceeding 300 tax units (UIT) with regard to period 2022), in the month of June, and taking into consideration tax period May 2023 (*) as the deadline.

(*) Established in Appendix I of Superintendence Resolution N. º 000117-2022/SUNAT

- The informative affidavit of the Beneficial Owner corresponding to Bracket III (legal persons declaring net income exceeding 300 tax units (UIT) with regard to period 2022), in the month of June, and taking into consideration tax period May 2023 (*) as the deadline.

(*) Established in Appendix I of Superintendence Resolution N. º 000281-2022/SUNAT

Liable taxpayers that shall subsequently file the affidavit

- Liable taxpayers not addressed in Superintendence Resolutions 185-2019/SUNAT, 000041-2022/SUNAT and 000278-2022/SUNAT shall file the affidavit in the term established by SUNAT through Superintendence Resolution.

Background:

In 2019, as stated in paragraph 5.2, subparagraph 5 of Superintendence Resolution 185-2019/SUNAT, the first group of taxpayers liable to file the informative affidavit of Beneficial Owner were:

- Legal persons which have the status of main taxpayers as of November 30, 2019, shall file the affidavit containing beneficial owner information as of that date.

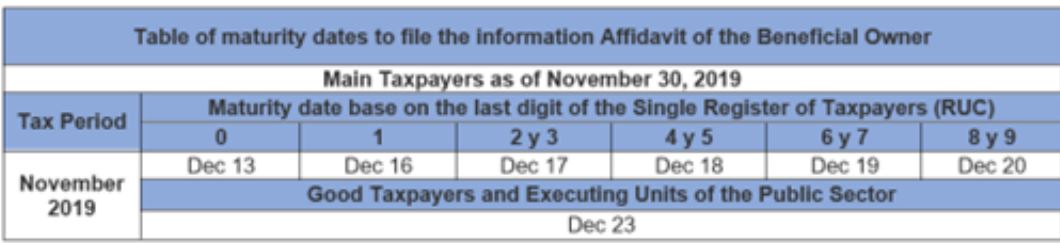

Also, it has been established that such affidavit shall be filed in December, and the deadline should be the date established in Appendix I of Superintendence Resolution 306-2018/SUNAT

for tax liabilities requiring monthly payments and corresponding to tax period November 2019. Therefore, the following deadline schedule was established:

1. UESP: Executing Units of the Public Sector.

Net Income estimation for determining the Brackets

International Taxation

International Taxation