By means of Legislative Decree 1623 published on August 4, 2024, a new VAT declaration and payment mechanism was established regarding the use, within the country, of digital services and import of intangible assets through Internet by Individuals not conducting business activities.

Digital services are necessarily provided through Internet (or another related virtual network) and they could be: streaming of audiovisual content, information storage, remote conference services, or the service provided by applications (apps) that connect users with service providers as it is the case of lessors and lessees to agree on the leasing of an immovable property, taxi apps, not free social networks charging for additional services, among others;

On the other hand, the import of intangible assets through Internet is related to acquired intangible assets that will be downloaded definitely, by the purchaser, through Internet (or other similar network), for example, downloading a program or antivirus.

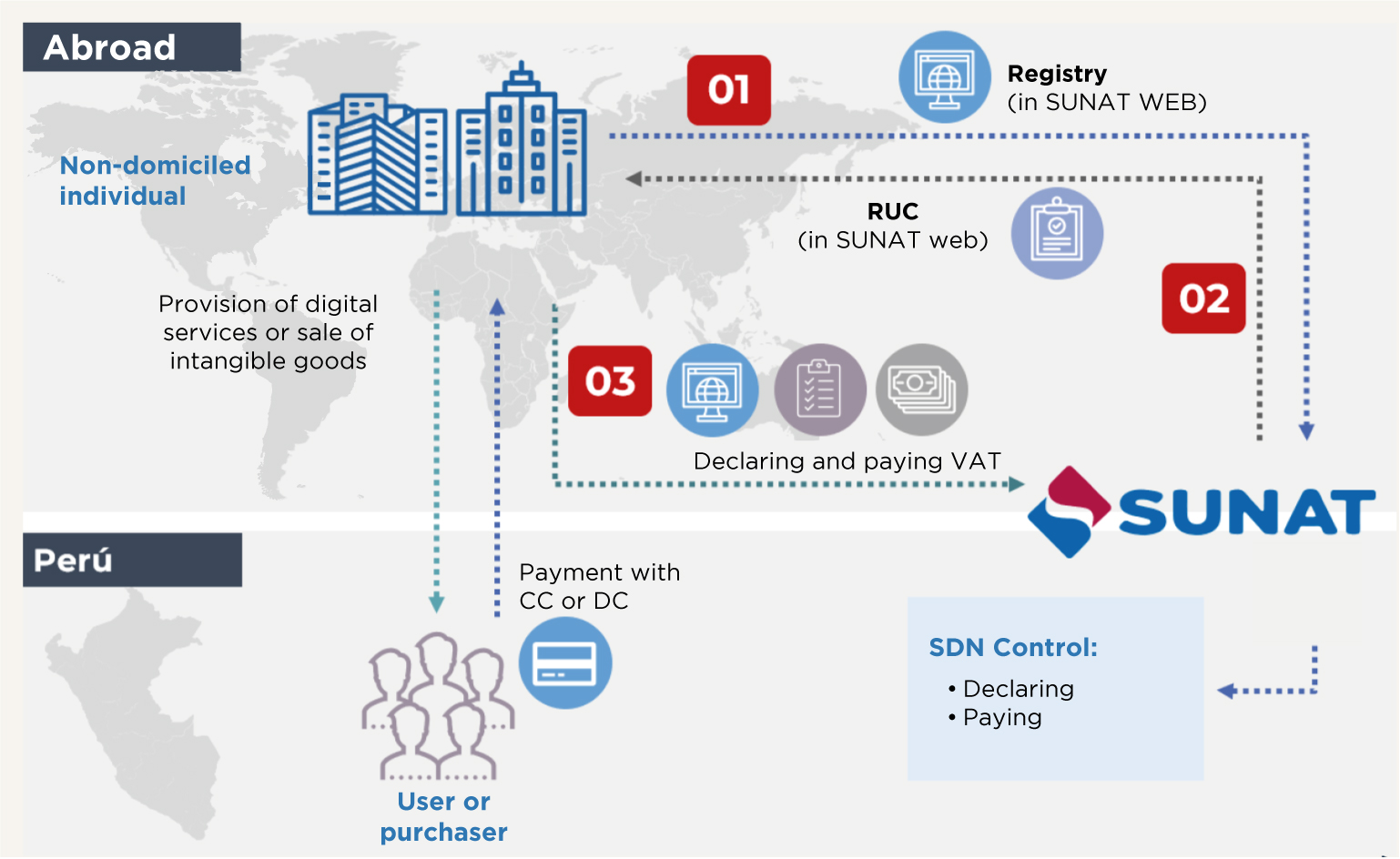

Even though these transactions were already taxed with the VAT, there was no effective declaration and payment mechanism; therefore, to solve this issue, by means of Legislative Decree 1623, the VAT declaration and payment system was adapted with the intention that non-domiciled individuals who are suppliers of these digital services and intangible assets (SND), become VAT withholding or collection agents that shall register in the Single Taxpayers’ Registry (RUC), declare and directly pay SUNAT

AT through virtual means, without the need of physical presence, as it is shown below:

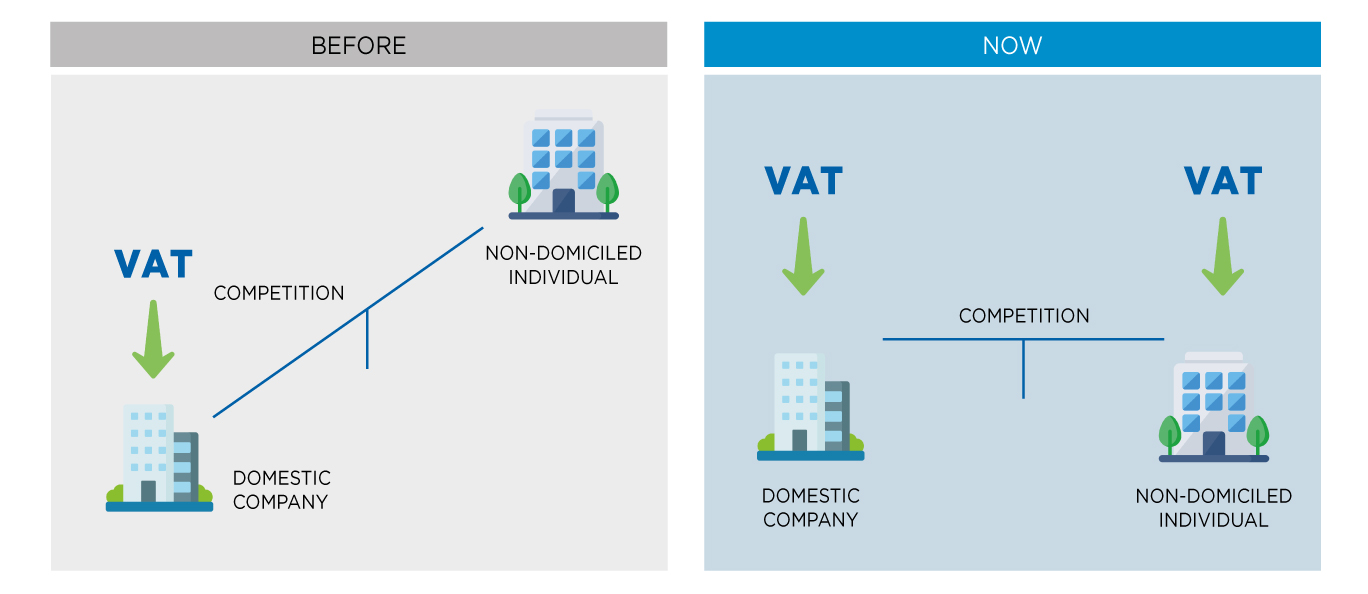

In this manner, we aim at balancing the conditions under which domestic digital services suppliers compete against foreign suppliers, to whom tax was not levied, since companies domiciled in Peru not only pay taxes, but also invest in services and acquisitions that create jobs and benefit the country’s economy.

This rule is specially significant because it is part of the standards and good international practices that Peru is implementing as part of the accession process initiated to become a member of the Organization for Economic Cooperation and Development (OECD) with the corresponding benefits for the development of the country on a long term basis.

On the basis of the abovementioned, the following is detailed:

Who is subject to taxation?

Those who import taxable assets or, in the case of individuals that do not conduct any business activity, every time they use, within the country, digital services provided by non-domiciled individuals.

Digital services subject to VAT

Digital services are defined as services that are available to the user through Internet or any adaptation of protocols, platforms or technology used by Internet, or any other network through which related services are provided by means of on-line access that is characterized for being essentially automated and will not be feasible due to the lack of information technology.

The following, among others, are considered digital services:

- On-line access and/or transmission of images, series, films, documentaries, short films, videos, music and any other digital content through streaming technology or any other type of technology.

- Information storage.

- Access to social network and/or provision of content or additional functions.

- Service provided by on-line magazines or newspapers

- Remote conference services

- Intermediation services on the supply and demand of goods and services.

In the specific case of digital services provided to an individual not conducting any business activity, it has been considered that such services are consumed or used in the national territory if the user of the service has a usual place of residence in the country.

It is worth mentioning that these transactions will be taxed with the VAT as long as there is a payment made by the user; that is, if they are provided “free of charge”, the VAT will not be paid.

Intangile assets imported through Internet subject to VAT

Intangible assets imported through Internet are defined as acquired intangible assets that will be downloaded permanently by the purchaser through Internet or any other adaptation or application of protocols, platforms or technology used by Internet or any other network through which intangible assets are acquired and downloaded on a permanent basis.

Also, it is mandatory that these intangible assets are aimed at the use and consumption within the country, which will be met if such purchaser has a usual residence in the country.

It is noted that these transactions will be taxed with the VAT as long as there is a payment made by the user; that is, if they are provided “free of charge”, the VAT will not be paid.

Usual Residence

In both cases, when the user of digital services or the purchaser of intangible assets imported through Internet is an individual not conducting a business activity, it is considered that their usual residence is in Peru, in any of the following assumptions:

- Peru is responsible for the internet protocol management or any other means of geographical location allocated to the electronic device through which digital services are provided or intangible asset is downloaded.

- Peru is responsible for the country code of the subscriber identity module card, physical or electronic, or any other technology replaced by the mobile terminal equipment through which digital services are provided and the intangible asset is downloaded.

- The payment of digital services or for the import of intangible assets should be made using credit or debit cards, or any support for the use of e-money or any other product provided by Peruvian financial system entities.

- The address registered by the individual as user details or address for the issuance of payment receipts to the supplier of digital services or the person from whom the intangible asset was acquired, shall be located in Peru.

- Other assumptions that might be established by the regulation.

Tax declaration and payment types or mechanisms

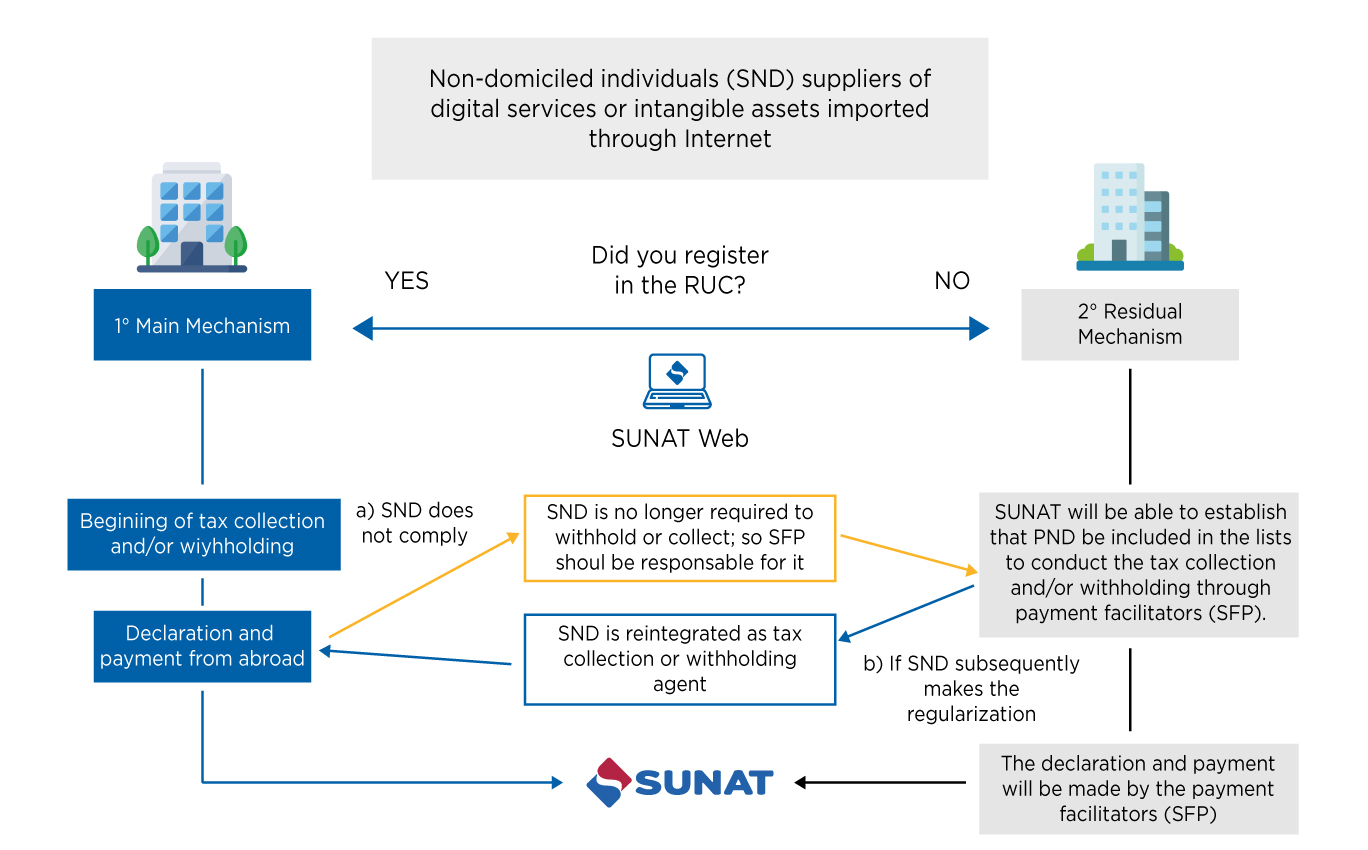

Non-domiciled suppliers of Digital Services or intangible assets imported through Internet (SND) are required to declare and pay the VAT arising from digital services and import intangible assets through Internet.

* Residual: when non-domiciled individuals do not comply with specific obligations, the persons responsible for declaring and making the payment of the VAT will be the payment facilitators (SFP) which will be implemented when the regulation is published.

Direct tax collection through non-domiciled individuals (SND)

1.1 Obligations of non-domiciled individuals (SND):

The non-domiciled individual providing the digital service or from whom the good is acquired:

- Acts as tax withholding or collection agent.

- Shall be recorded in the Single Taxpayers’ ID Registry (RUC), in conformity with the regulations of such registry.

- It is not required to have an established Address in the country.

- The designated representative does not require an address in the country, for RUC registration purposes.

- RUC registration does not imply the incorporation of a permanent establishment in the country.

- They are not required to keep accounting books or other books and registries demanded by Peruvian law, nor are they required to issue payment receipts for such transactions.

1.2.Based on the type of transaction with or without intermediation in the supply and demand:

1.1 No intermediation in supply and demand

In the import of intangible assets through Internet and in the use of digital services that do not imply intermediation in the supply and demand of an underlying transaction, the non-domiciled individual from whom the intangible good is acquired or who provides the digital service receives the amount resulting from applying the VAT rate on the total sales value or the compensation.

1.1.2 Through intermediation in supply and demand

When the use of digital services implies the intermediation in the supply and demand of an underlying transaction, the non-domiciled individual providing the intermediation service:

- Acts as VAT collection agent responsible for paying the user or purchaser for the underlying transaction, for the use of the intermediation service in the country. Tax collection is made when charging.

- Acts as tax withholding agent responsible for paying the provider or seller for the underlying transaction, for the use in the country of the intermediation service. The withholding is made when the non-domiciled individual transfers to the checking or savings account of the provider or seller of the underlying transaction, the amount paid by the user or purchaser of such transaction.

Underlying Transaction: the underlying transaction is understood as the transaction conducted between the seller of a good or provider of a service and the party interested in acquiring that good or service; and which is the result of the non-domiciled individual rendering the service of intermediation in the supply and demand. The underlying transaction may be taxed, not taxed or exempted from VAT according to the rules on this matter.

- 2.3 Verification of the consumption or use in the country and the individual using the service or importing the intangible asset: The non-domiciled individual makes the withholding or collection when digital services or intangible assets imported through Internet are intended for the use or consumption in the country and the individual does not conduct any business activity, for which, it verifies:

- That they are registered in the platform by selecting the option corresponding to individuals and using their name, last names and identity document; or

- Using these last personal details when the platform has one single registration option that does not make the difference between individuals and companies.

- the usual residence of the user or acquirer shall be located in Peru (according to the indicated assumptions to be considered as Usual Residence).

In cases in which the registration on the platform of the non-domiciled does not include the choice of selecting the option or entering the personal data referred to in the previous paragraph, it shall be understood that the individual does not carry out a business activity.

- 2.4 Declaration and payment of withheld or collected VAT:

- Non-domiciled individuals shall file the tax return and make the payment of the withheld or collected VAT every month within the first ten (10) working days of the following month, under the form and conditions established by SUNAT.

- The declaration and payment could be made in domestic currency or in US dollars. The option is feasible in the tax return corresponding to January and is maintained during the whole year. As an exception, this option may be exercised for the declaration and payment corresponding to December 2024.

- SUNAT could set out that the above mentioned individuals file the annual informative affidavit under the form, term and conditions established by Superintendency Resolution, providing the details of the transactions subject to withholding or collection.

- The time zone considered to determine the date when the tax return is filed and the payment made will be the Peruvian official time, GMT-5.

1.5 Tax withholdings or collections applied to individuals conducting a business activity:

In cases when the non-domiciled individual withholds or collects to individuals conducting a business activity, they could use the withheld or collected tax as tax credit, provided that:

- The non-domiciled individual would have paid the tax administration, the amount of the tax withholding or collection made; and

- The substantial and formal requirements of tax credit that anticipate the regulations on this matter, shall be complied

- The document supporting the use as tax credit of the withheld or collected VAT to the individual conducting the business activity, is the document issued by the non-domiciled individual in which the value of the transaction is shown regardless of the compliance with other aspects stated in the supplementary provision.

2. Tax collection through Payment Facilitators (SFP)

1. When the SFP are required to withhold or collect the VAT instead of non-domiciled taxpayers (PND) :

The VAT is withheld or collected by payment facilitators (SFP) when the non-domiciled taxpayer incurs in any of the following assumptions:

a) Not registering in the Single Taxpayers’ Registry (RUC)

b) Not filing the tax return or making the total payment of the withheld or collected VAT within the deadline, for two consecutive months or alternating them.

c) Not filing the annual informative affidavit within the deadline.

This residual declaration and payment mechanism will be implemented through the future regulation.

International Taxation

International Taxation