2.1.1. Transactions subject to IGV

In the case of the rendering of services by a non-domiciled subject in favor of a Peruvian domiciled subject, the use of the service will be taxed with the IGV (Value Added Tax), provided that the service is consumed or used in the national territory.

2.1.2. Subject of the Tax

In the case of the use of services in the country, the Peruvian domiciled entity using the service must pay the VAT as a taxpayer. In other words, the non-domiciled entity is not subject to the tax.

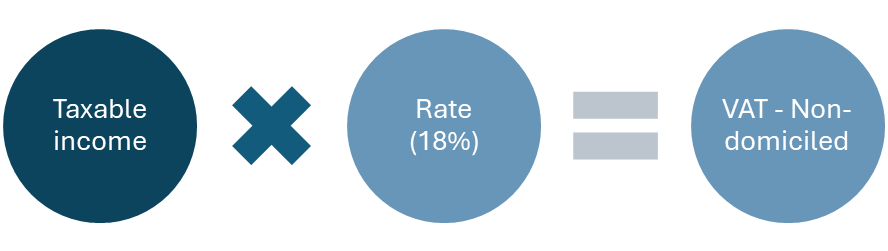

2.1.3. Calculation of VAT

In the use of services of non-domiciled persons, the taxable base will be constituted by the total amount of the remuneration. The value of the remuneration for services must be understood as the total amount that the Peruvian user of the service is obliged to pay. To this taxable base the tax rate will be applied, in this case, 18%.

2.1.4. Frequently Asked Questions

I am a Colombian company that provided a service that was used in Peru by a Peruvian company. Do I have to pay the tax?

No. The Peruvian company as user of the service will be the one to calculate and pay the corresponding tax.

I am a Mexican company that provided a service to a Peruvian company. For VAT purposes, is the Peru-Mexico DTA applicable?

The provisions of the Peru - Mexico treaty are not applicable, since it regulates double taxation with respect to income tax.

How should digital services provided by foreign companies to individuals in Peru be taxed?

It is recommended to see the section VAT -Digital Services.

2.1.5. Reports issued by SUNAT

REPORT N0. 228-2004-SUNAT/2B0000

REPORT N0. 111-2005-SUNAT-2B0000

REPORT N0. 002-2019-SUNAT/7T0000

*Las versiones en inglés de estos documentos están siendo preparadas.

2.1.6. Jurisprudence of the Tax Court

Resolution No. 03849-2-2003 - Place where the first act of service provision takes place.

Resolution No. 11052-8-2021 - Temporary and limited assignment of rights qualifies as a service.

Resolution No. 01113-8-2022 - Granting of licenses for the distribution of films in Peru

International Taxation

International Taxation