Direct and Indirect Credit [1]

1.3.1. Concept and characteristics of direct and indirect credit

Direct and indirect credits are mechanisms to alleviate international economic double taxation, i.e., they are concepts that taxpayers domiciled in the country (Peru) may deduct from their annual income tax, under certain conditions, in order to avoid or reduce the effect generated by double taxation.

[1] NOTE: This figure applies only to Residents

The direct credit consists of the deduction of the income tax paid by the taxpayer abroad for income obtained from foreign sources that is taxed under the local Income Tax Law (LIR).

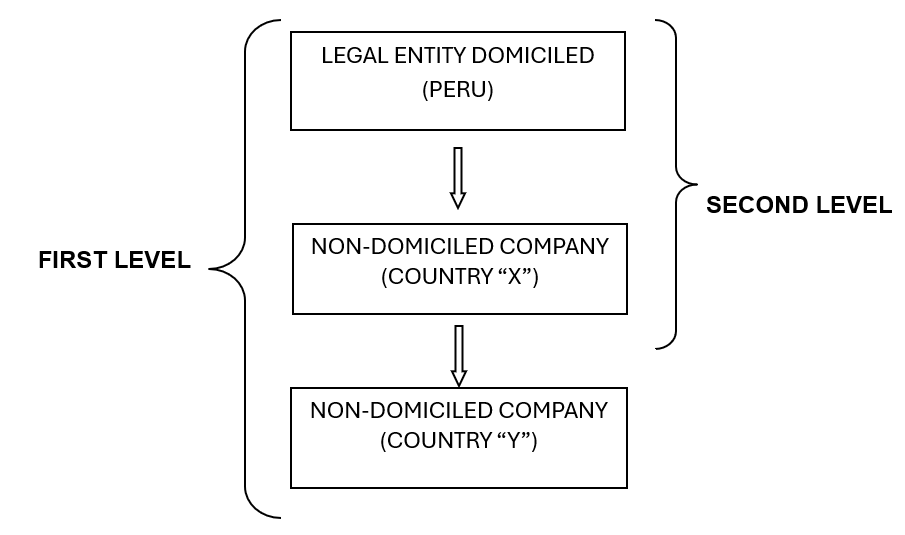

The indirect credit consists of the deduction made by the taxpayer (legal entity) of the income tax paid or withheld abroad for dividends or profits distributed by a non-domiciled company (first or second level) as well as the income tax paid by the latter, in the proportional part corresponding to the dividends or profits distributed to the legal entity domiciled in the country.

1.3.2. Requirements for deduction

Direct Credit:

The direct credit may be used provided that it does not exceed the amount resulting from applying the taxpayer's average rate to the income obtained abroad, nor the tax actually paid abroad.

Indirect Credit:

The indirect credit can only be used by legal entities (*) domiciled in the country and applies to two levels. The second level company must be resident in the same country as the first level company, or in a country with which Peru has an information exchange agreement.

(*) Permanent establishments and business collaboration contracts with independent accounting are excluded.

Minimum participation of the domiciled legal entity in a non-domiciled company:

10% of the voting shares of the non-domiciled company.

Directly or indirectly (first or second level).

In the 12 months prior to the dividend or profit distribution date.

The indirect shareholding is determined by multiplying the shareholding in the first level non-domiciled company by the shareholding that the latter has in the second level company.

The deduction is made in the year in which the foreign source income corresponding to the dividends or profits distributed to the domiciled legal entity is imputed; only the taxes paid or withheld abroad within the due date for filing the annual income tax filing for such year must be included in the determination of the amount to be deducted.

Tax paid abroad by companies resident in non-cooperating countries or territories, or in countries with low or no taxation, or for income, revenues or profits subject to a preferential tax regime, is not considered.

The participation of the domiciled legal entity in the first or second level non-domiciled companies must be accredited with a reliable document.

The domiciled taxpayer must provide the following information in a register kept by SUNAT, within the term established for filing the annual income tax filing:

The shareholding of the taxpayer in the first and second level non-domiciled companies.

The dividends distributed by the first and second level non-domiciled companies, indicating, among others, the fiscal year to which such dividends correspond.

Legal Basis: Subparagraph f) of article 88° of the LIR, article 58°-A of the LIR Regulations and Superintendence Resolution No. 059-2020/SUNAT.https://www.sunat.gob.pe/legislacion/superin/2020/059-2020.pdf

1.3.3. General forms of accreditation

In order to deduct credits for taxes paid abroad referred to in subparagraphs e) and f) of Article 88 of the LIR, the following must be taken into account:

They must be accredited with the proof of payment or withholding issued by the tax authority, or with a reliable document.

They must be related to foreign source income taxed in the country (Peru).

Must meet the characteristics of income taxation.

They are converted into local currency using the weighted average exchange rate corresponding to December 31 of the year in which the income is imputed, published by the SBS on its website or in the Official Gazette El Peruano.

Legal Basis: Subparagraph f) of article 88 of the Income Tax Law and article 58 of its Regulations.

1.3.4. Items not considered as taxes paid abroad.

It is not considered tax paid abroad:

The tax levied on dividends or profits, in the part corresponding to income attributed to taxpayers domiciled in the country in application of the international tax transparency regime.

The tax that is not definitive, that is voluntary or optional, that is subject to refund, reimbursement or reimbursement or that is statute-barred.

When its application in the country of taxation depends on being admitted as a credit against income tax in the country to which the dividends or profits are distributed.

Legal Basis: Subparagraph f) of Article 88 of the LIR.

1.3.5. Treatment of unapplied credits

The amount of tax paid abroad that is not used in the fiscal year:

It cannot be compensated in other fiscal years.

It does not give the right to a refund.

The direct credit does not apply with respect to taxes paid abroad for the distribution of dividends or profits, when the indirect credit is applicable.

Legal Basis: Subparagraphs e) and f) of Article 88 of the Income Tax Law.

1.3.6. Form of calculation of direct credit

The amount to be deducted cannot exceed:

1. The amount resulting from applying the average rate to foreign source income:

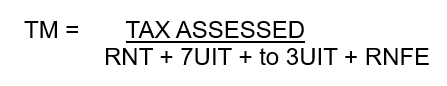

For an Individual:

For a Legal Entity:

Where:

TM = Average Rate

UIT = Peruvian Tax Unit

RNT = Net Employment Income

RN3ra = Net Business Income (Third Category)

RNFE: Net Foreign Source Income

2. The tax actually paid abroad.

Legal Basis: Subparagraph e) of Article 88 of the Income Tax Law.

1.3.7. Indirect credit calculation method

i. Income tax paid by the non-domiciled first-tier corporation

The legal entity domiciled in the country must add to its net income the income tax paid by the first level non-domiciled company, in the proportional part corresponding to the dividends or profits distributed, in order to determine the income tax for the year.

The amount of the deduction is the lower of the following amounts:

i. The income tax effectively paid abroad, made up by the sum of the amount of the income tax paid by the first level non-domiciled company plus the amount of the tax paid or withheld abroad for the dividends or profits distributed; and,

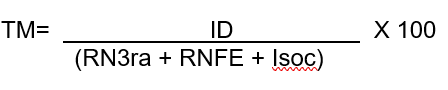

ii. The tax that would have been payable in the country on the total foreign income, which is the result of applying the average rate of the taxpayer to the sum of the amount of the dividends or profits distributed (without deducting the withholding or payment of tax abroad for their distribution) plus the income tax paid by the first-tier non-domiciled company. For this purpose, the average rate is calculated as follows:

TM: Average Rate

ID: Tax determined for the taxable year (**)

RN3ra: Net income or net loss of third category, as applicable. If there are losses of the third category from previous years, these are not subtracted from the net income.

RNFE: Net foreign source income.

Isoc: Income tax paid by the first level non-domiciled company.

(**) To determine the income tax for the year, the domiciled legal entity must add to its net income the income tax paid by the first level non-domiciled company.

Income tax paid by the non-domiciled second-tier company

The domiciled legal entity must add to its net income the income tax paid by the first and second level non-domiciled companies, in order to determine the income tax for the year.

The amount of the deduction is the lower of the following amounts:

i. The income tax effectively paid abroad, made up by the sum of the amount of income tax paid by the first and second level non-domiciled companies, plus the amount of income tax paid or withheld abroad for dividends or profits distributed to the legal entity domiciled in the country; and,

ii. The tax that would have been payable in the country for the total income obtained abroad, which is the result of applying the average rate of the taxpayer to the sum of the amount of the dividends or profits distributed (without deducting the withholding or payment of tax abroad for their distribution) plus the income tax paid by the first and second level non-domiciled companies. For this purpose, the average rate is calculated according to the formula indicated above, adding in the denominator the income tax paid by the second level non-domiciled company.

Legal Basis: Subparagraph f) of Article 88 of the Income Tax Law.

1.3.8. Frequently Asked Questions

What is direct credit?

The direct credit is the deduction by the Peruvian domiciled taxpayer of the income tax paid abroad on income obtained from foreign sources that is taxable under the local Income Tax Law.

When does direct credit apply?

The direct credit applies when it is verified that the domiciled taxpayer has obtained foreign source income.

What is the direct credit limit?

The direct credit may be used as long as it does not exceed the amount resulting from applying the taxpayer's average rate to the income obtained abroad, nor the tax effectively paid abroad.

What is indirect credit?

The indirect credit consists of the deduction made by the taxpayer (legal entity) of the income tax paid or withheld abroad for dividends or profits distributed by a non-domiciled company (first or second level) as well as the income tax paid by the latter, in the proportional part corresponding to the dividends or profits distributed to the legal entity domiciled in the country.

When does indirect credit apply?

The indirect credit is applied when it is verified that the legal entity domiciled in the country has directly or indirectly obtained dividends or profits distributed by a non-domiciled company.

What is the indirect credit limit?

The amount of the deduction is the lesser of the amount compared:

The income tax effectively paid abroad; and

The tax that would have been payable in the country for the total foreign income.

What is article 88° of the Income Tax Law?

What is the purpose of the credit for income taxes paid abroad?

The objective is to avoid double taxation and allow Peruvian domiciled taxpayers to compete on equal terms in the international market.

1.3.9. Reports issued by SUNAT.

REPORT No. 023-2015-SUNAT/5D0000

REPORT No. 074-2016-SUNAT/5D0000

REPORT No. 024-2017-SUNAT/7T0000

REPORT No. 135-2019-SUNAT/7T0000

1.3.10. Jurisprudence of the Tax Court

RTF N.° 03110-5-2021 - Treatment of Income Tax paid by the company domiciled in a country with which a DTA has been signed. It cannot be deducted as a credit against Peruvian income tax.

RTF N.° 06803-2-2021 - Similar criteria

International Taxation

International Taxation