1.2.1. Taxable income from Peruvian sources

Individuals not domiciled in Peru are subject to income tax on their Peruvian source income, considering as Peruvian source income, among others, income from the sale of shares representing capital of companies incorporated or established in Peru.

Legal basis: Subparagraph h) of article 9 of the Income Tax Law.

1.2.2. Determination of taxable income for non-domiciled persons

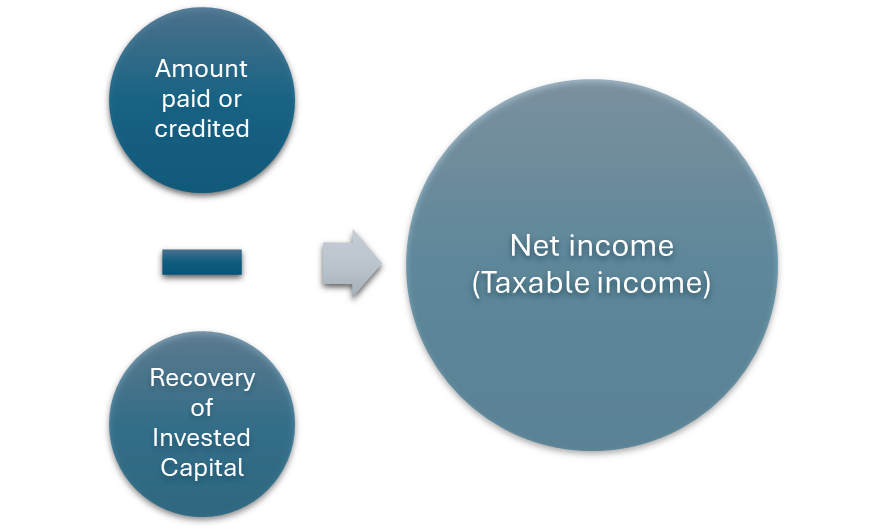

The Income Tax Law establishes that, without admitting proof to the contrary, the net income or taxable amount of the tax payable by non-domiciled persons is the amount resulting from deducting the recovery of the invested capital from the amount paid or credited for the disposal.

Legal basis: Subparagraph g) of the second paragraph of article 76 of the Income Tax Law.

1.2.3. Invested Capital Recovery Deduction

In order to be entitled to the deduction for the recovery of invested capital, i.e., of the computable cost of the shares, the non-domiciled taxpayer must obtain from SUNAT a Certificate of Recovery of Invested Capital, through which the Tax Administration recognizes such amount.

This Certificate will be issued by SUNAT within thirty (30) days after the request is filed and after the evaluation of the documentation provided on the cost of the shares to be sold or to be sold. In case SUNAT has not ruled on the request within such term, the Certificate will be understood to be granted in the terms expressed by the non-domiciled subject.

Finally, the Income Tax Law establishes that the deduction for recovery of the invested capital will not be applicable with respect to payments or credits prior to the issuance of the Certification by SUNAT.

Legal basis: Article 57 of the Income Tax Law Regulations.

1.2.4. Invested capital recovery certificate

In relation to the validity of the Certificate of Recovery of Invested Capital issued by SUNAT, the following should be taken into account:

This will be maintained for a period of 45 calendar days from its issuance, provided that, as of the date of disposal in question, the computable cost of the shares does not change.

In the event that at the date of disposal the computable cost of the shares varies, the issuance of a new certificate shall be required.

Legal basis: Article 57 of the Income Tax Law Regulations.

1.2.5. Application for the issuance of a Certificate of Recovery of Invested Capital

In order to obtain the Invested Capital Recovery Certificate, its issuance may be requested through the Virtual Desk or through any of SUNAT's Taxpayer Service Centers nationwide. For such purpose, the following must be submitted:

Application requesting the issuance of the certification for purposes of the recovery of the invested capital, signed by the non-domiciled taxpayer or his legal representative.

Submit information and supporting documentation to prove the computable cost of the assets or rights to be sold or to be sold, for which the certification is requested, in accordance with the provisions of Articles 20 and 21 of the Income Tax Law and Article 11 of the Regulations.

Minimum information to be included in the application

Taxpayer Service Center in Lima

Taxpayer Service Center in Province

Legal basis: Procedure 49° of the Single Text of Administrative Procedures of SUNAT.

1.2.6. Tax rate applicable to non-domiciled persons

Non-domiciled individual | Rate |

Individuals and undivided estates | 30% |

Legal entity |

Legal basis: Articles 54 and 56 of the Income Tax Law.

1.2.7. Withholding and/or payment of the tax

Income Tax Payer | Income Beneficiary | Withholding or Payment |

Individual domiciled in Peru | Individual not domiciled in Peru | The person domiciled in Peru must withhold and make the final payment within the deadlines set forth in the Schedule of Monthly Obligations. |

Individual not domiciled in Peru | Individual not domiciled in Peru | Withholding is not applicable when the payer is a non-domiciled taxpayer; therefore, the non-domiciled taxpayer must pay the tax directly within the following twelve business days of the month following the month in which the income was received. |

Legal basis: Article 76 of the Income Tax Law. Article 39-A of the Income Tax Law Regulations.

1.2.8. Jointly Liable Parties for Withholding and Payment

Income Tax Payer | Income Beneficiary | Responsable solidario |

Individual domiciled in Peru | Individual not domiciled in Peru | The withholding agent: Persons or entities paying or crediting income of any nature to non-domiciled beneficiaries. |

Individual not domiciled in Peru | Individual not domiciled in Peru | Legal entity domiciled in the country issuing the shares: If it is directly or indirectly related to the non-domiciled individual disposing of such securities in any of the twelve (12) months prior to their disposal. |

Legal basis: Article 68° and 71° of the Income Tax Law. Subclause 2 of Article 18 of the TUO of the Tax Code.

1.2.9. Frequently Asked Questions

I am a non-domiciled person who sold shares of a Peruvian company to another non-domiciled person. How do I pay the tax directly?

You can make the payment directly through Payments without SOL password

I am a Swiss foreign investor who will sell shares of a Peruvian company. Do I have to pay tax in Peru and in Switzerland?

Peru has a network to Avoid Double taxation Agreements (DTA). In this case, the provisions of the Peru-Switzerland DTA should be taken into account.

I am a non-domiciled person who sold shares on November 15. When do I have to pay the tax?

The payment of the tax must be made within twelve working days of the month following the month in which the income was received; in this case, up to a maximum period of 12 working days in the month of December.

1.2.10. Reports issued by SUNAT

REPORT No. 112-2007-SUNAT/2B0000

REPORT No. 173-2013-SUNAT/4B0000

REPORT No. 054-2014-SUNAT/4B0000

REPORT No. 075-2019-SUNAT/7T0000

1.2.11. Jurisprudence of the Tax Court

Resolution No. 04041-8-2014 - Positive administrative silence of the application

Resolution JOO No. 01580-10-2019 - Exchange rate for the determination of computable cost

Resolution No. 00046-5-2022 - Use of means of payment to support computable costs.

International Taxation

International Taxation